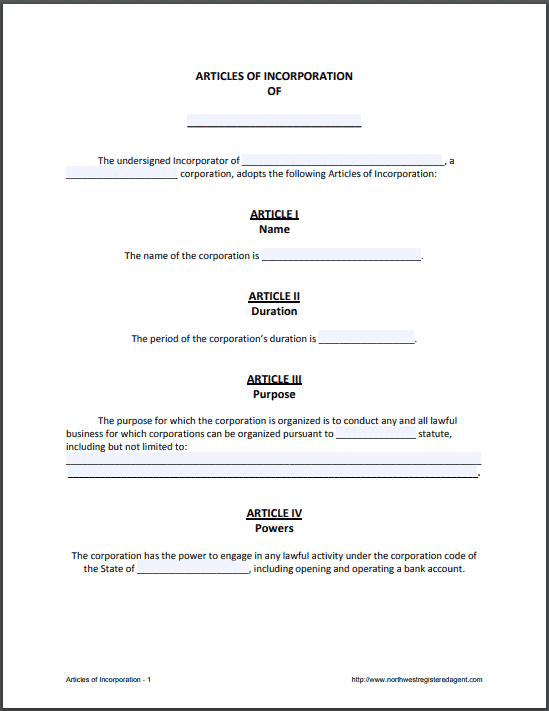

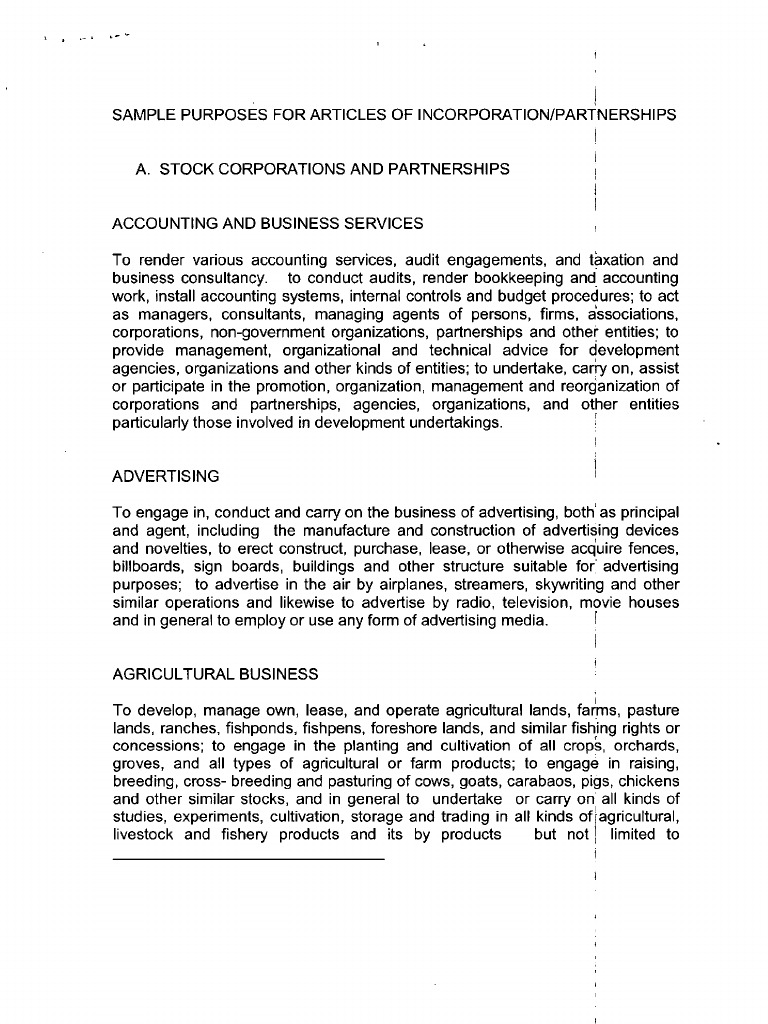

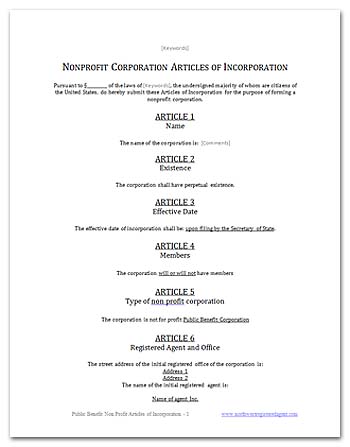

Articles Of Incorporation Nonprofit Template. This document is intended to be used as a sample or model In some states, nonprofit corporations are required to publish notice of their intention to file or their filing of the Articles of Incorporation. Use our proven articles of incorporation templates and samples!

No special or pricey software subscriptions needed.

A nonprofit corporation allows for all the formalities and protections of a corporation, minus the profit motive and tax issues.

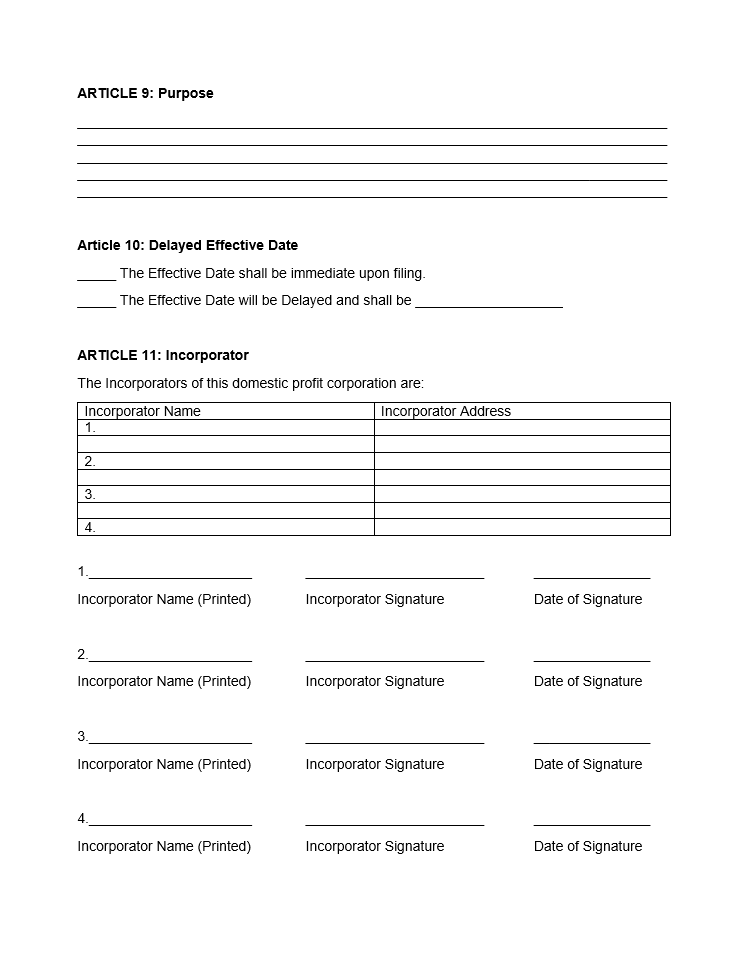

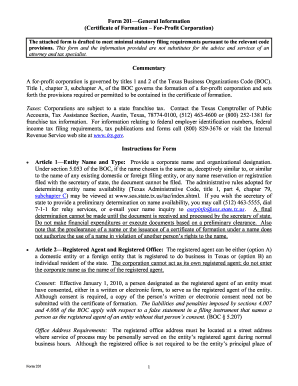

The template already has the IRS required Nonprofit Articles of Incorporation get filed at the state level in the US—typically with the office of the secretary of state or an equivalent state agency. To form a nonprofit corporation: File nonprofit articles of incorporation (or a certificate of incorporation) with the appropriate state agency, along with payment of the required fee. Nonprofit Corporation Act shall not adversely affect any right or protection of a director and/or.