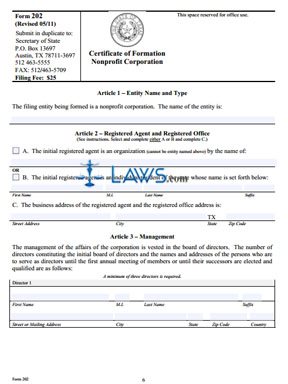

Articles Of Incorporation Texas Nonprofit. Texas-based nonprofits must follow the guidelines laid out in the Texas Non-Profit Corporation Act in order to obtain corporate status. Sometimes you're required to add a short paragraph after the heading, stating that the incorporators Article III may be the most critical for getting your nonprofit corporation established and, ultimately, approved for tax exemption by the IRS.

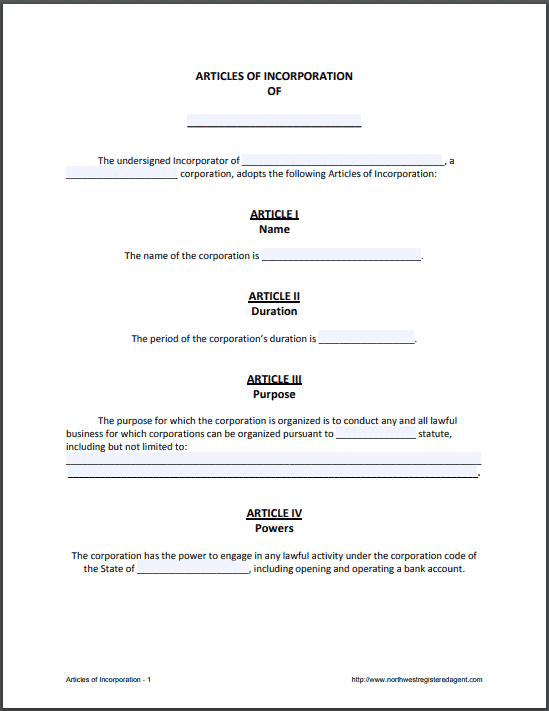

Articles of Incorporation are used the incorporate a business within a state; most states handle incorporation through their Secretary of State office.

Incorporating a nonprofit involves the filing of a formation document, usually referred to as Articles of Incorporation, unless TEXAS REQUIRES FILING: Yes, must have IRS Determination Letter to file FORM NAME: Texas Application for Exemption FORM NUMBER.

Download sample article of Incorporation/Certificate of Incorporation for a Texas nonprofit organization. A nonprofit corporation organized to provide places of burial is exempt from the franchise tax. Articles of incorporation form a document that establishes a corporation as a separate business entity.